Investis.com

Safe harbor

This presentation may include forward-looking statements that are based on our management's beliefs andassumptions and on information currently available to our management.

The inclusion of forward-looking statements should not be regarded as a representation by Cosmo that any ofits plans will be achieved. Actual results may differ materially from those set forth in this presentation due tothe risks and uncertainties inherent in Cosmo's ability to develop and expand its business, successfullycomplete development of its current product candidates and current and future collaborations for thedevelopment and commercialisation of its product candidates and reduce costs (including staff costs), themarket for drugs to treat IBD diseases, Cosmo's anticipated future revenues, capital expenditures and financialresources and other similar statements, may be "forward-looking" and as such involve risks and uncertaintiesand risks related to the collaboration between Partners and Cosmo, including the potential for delays in thedevelopment programs for Budesonide MMX® and Rifamycin SV MMX®. No assurance can be given that theresults anticipated in such forward looking statements will occur. Actual events or results may differ materiallyfrom Cosmo's expectations due to factors which include, but are not limited to, increased competition, Cosmo'sability to finance expansion plans, the results of Cosmo's research and development activities, the success ofCosmo's products, regulatory, legislative and judicial developments or changes in market and/or overalleconomic conditions. Cosmo assumes no responsibility to update forward-looking statements or to adapt themto future events or developments.

You are cautioned not to place undue reliance on these forward-looking statements, which speak only as ofthe date hereof, and Cosmo undertakes no obligation to revise or update this presentation.

Cosmo R& D day: the evolution of Cosmo

• Mauro Ajani, CEO• Luigi Moro, CSO• Chris Tanner, CFO

• The entrepreneurial challenge

• From contract drug manufacturer• To MMX based products focused on IBD• To larger diseases and new MMX applications

• The MMX technology

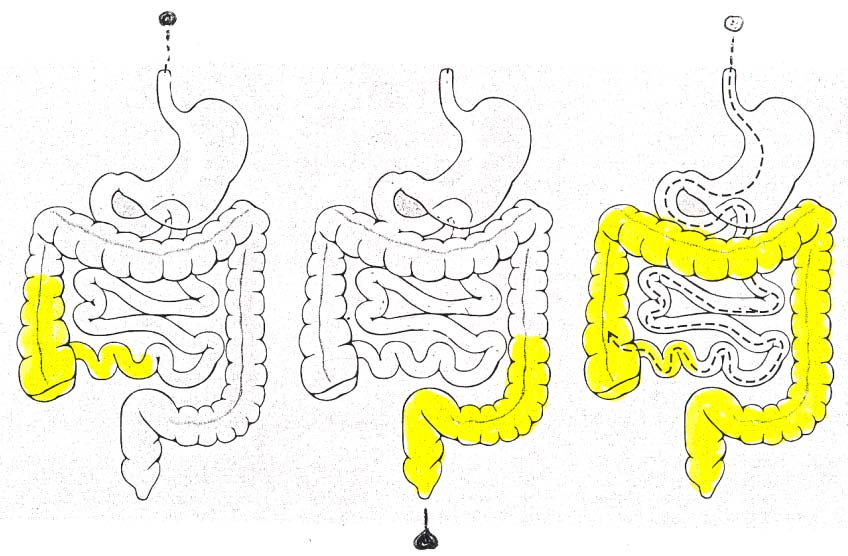

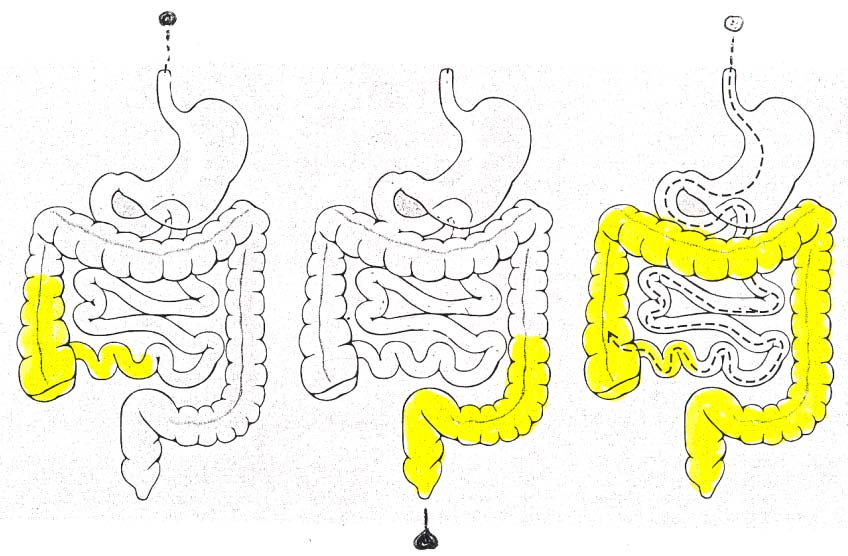

IBD medications: sites of action

MMX™ tablets vs. other dosage forms

Oral dosage forms

MMX: Proving extended release and persistence

of radioactive traces released by MMX in gut

4h 30' ascending colon

7h 30' trasverse colon

10h trasverse colon

16h descending colon

Focus on IBD, a disease with little recent

LMW Heparin MMX®

Sandimmun Neoral* : 1995

Prednisolone: late 50's

Lialda®/Mezavant ®/Mesavancol ®

Entocort EC *: 2001

Launch date: 2007

Rifamycin SV MMX®

Pentasa* : 1993

Ciproxin*: late 80's

Diet (+ Probiotics)

Zacol NMX®

1. Status of disease severity° EU

Product and Indication

Phase III

Lialda ®/ Mezavant ®/Mesavancol®

Mild to moderate Ulcerative Colitis

3 EASTERN

Intestinal Disorders (nutraceutical)

EUROPEAN

Budesonide MMX®

Ferring – Worldwide

(excluding Japan & USA)

Mild to moderate Ulcerative Colitis

USA H2/12

Rifamycin SV MMX®

H2/11 USA

Dr. Falk – Europe & Australia

(excluding Italy)

Dose ranging

- Clostridium Dificile

LMW Heparin MMX®

- Induction of remission in M2M UC

- Maintenance treatment for UC of all

Opioid Induced Constipation

Pk & Irrit.

androgen

androgen

• Lialda MMX

The first product: Lialda®

• The active ingredient Mesalamine [or 5-ASA or amino salicylic acid] is

an off-patent chemical entity, used since the years ‘60 in the intestinal

inflammatory diseases

• The product is indicated for Patients with Ulcerative Colitis of mild to

moderate severity

• Market entry in March 2007. revenue 2009 $ 210 m. Analysts

projections for 2010: $ 293 m (Europe will come on-stream); for 2011

• Competing products in 2009 were Asacol $ 684 m; Pentasa $236 m;

Canasa $ 95 m all with increased sales but decreasing TRX.

What does the ANDA filing mean

• Zydus filed aNDA for 1200 mg Mesalamine tablets in May 2010; Shire

has filed law suit for patent infringement• Whilst this is pending the FDA will not act on the ANDA

• To date FDA required generics need to prove bioequivalence for 5-ASA

and pro-drugs in IBD by conducting clinical trials

• New ruling by FDA in July 2010 to determine bioequivalence

• in vitro dissolution tests and • comparative PK/safety studies

• Demonstrating identical dissolution/PK profile to our extended release

MMX technology will be very challenging

• Shire is completing clinical trials for Lialda in Diverticulitis. If FDA

approves, they will be granted a New Use/New Clinical Studies

exclusivity for Lialda for an additional three years

Cosmo revenue scenarios for Lialda

• Diverticulitis approved, Patent challenge loses

• Peak sales $ 1 b, discount rate 10%, post tax NPV per share of CHF

• Diverticulitis not approved, Patent challenge loses

• Peak sales $ 590 m, discount rate 10%, post tax NPV per share of

• Diverticulitis approved, Patent challenge succeeds

• Peak sales $ 543 m, loss of sales 50%, discount rate 10%, post tax

NPV per share of CHF 5.96

• Diverticulitis not approved, patent challenge succeeds

• Peak sales $ 500 m, loss of sales 50%, post tax NPV per share of

• Budesonide MMX

NORTH AMERICA & INDIA

Preliminary Results of EU Phase III study

Efficacy: primary endpoint attained

Number of

Patients in

patients ITT

Budesonide MMX 9 mg

Budesonide MMX 6 mg

Entocort EC 3 x 3 mg(a)

Number of

Patients in

patients PP

Budesonide MMX 9 mg

Budesonide MMX 6 mg

Entocort EC 3 x 3 mg(a)

*Statistically significant vs placebo at 0.025

** Statistically significant vs placebo at 0.05

(a)Not powered to show statistical difference between MMX arms and Entocort

Preliminary Results of US Phase III study

Efficacy: primary endpoint attained

Number of

Patients in

patients ITT

Budesonide MMX 9 mg

Budesonide MMX 6 mg

Asacol reference arm(a)

Number of

Patients in

patients PP

Budesonide MMX 9 mg

Budesonide MMX 6 mg

Asacol refernece arm(a)

Preliminary Results of Phase III studies

ITT populations analysis

All patients included in the ITT populations of single trials are considered

EU - Treatment arm

Number of patients Patients

Budesonide MMX 9 mg

Budesonide MMX 6 mg

Entocort EC 3 x 3 mg(a)

US - Treatment arm

Number of patients Patients

Budesonide MMX 9 mg

Budesonide MMX 6 mg

Asacol 2x400mg TID

EU + US - Treatment arm

Number of patients Patients

Budesonide MMX 9 mg

Budesonide MMX 6 mg

Preliminary Results of Phase III studies

PP populations analysis

All patients included in the PP populations of single trials are considered

EU - Treatment arm

Number of patients Patients

Budesonide MMX 9 mg

Budesonide MMX 6 mg

Entocort EC 3 x 3 mg(a)

US - Treatment arm

Number of patients Patients

Budesonide MMX 9 mg

Budesonide MMX 6 mg

Asacol 2x400mg TID

EU + US - Treatment arm

Number of patients Patients

Budesonide MMX 9 mg

Budesonide MMX 6 mg

Preliminary Results of US Phase III study

Safety – Treatment Emergent Adverse Events (TEAEs)

Treatment

MOD. SEVERE TREATMENT

Preliminary Results of EU Phase III study

Safety – Treatment Emergent Adverse Events (TEAEs)

Treatment

MOD. SEVERE TREATMENT

Preliminary Results of US Phase III study

Safety - Plasma cortisol

screening

Final visit

NB: Central laboratories quote a normal range of 138-690 nmol/L

for morning cortisol

Preliminary conclusions of EU + US Phase III study

• Significant superiority vs. placebo in the primary

endpoint (-> allows product submission of MAA)

• Similar primary end point remission rate in EU and US

• Higher remission rates for 9 mg than 6 mg

• Higher remission rates than Entocort and Asacol

• Tolerability profile and side effects comparable to

What is remission? Substantial variations in medians

What is remission? Substantial differences in placebo remission rates

What is remission?

• Definition of Registration remission as determined by

the Regulator, has been getting increasingly stringent

• Definition of patients has become more precise

• Use of colonoscopy at entry• Use of histology at entry

• Definitions of clinical endpoints has become more stringent

• Move from UCDAI 2 to ≤1 or 0

• Measurement of clinical endpoints has become more precise

• From patient observation, to sigmoidoscopy, to

colonoscopy, to two colonoscopies

Budesonide MMX®: going forward

• Projected filing

• MAA in EU in H1 2011; NDA for USA H2 2011

• Market entry

• Market

• In USA there is no steroid approved for mild to moderate UC• 2009 Entocort sales at $ 237 m equal to Lialda® for a patient base 2/3 that of

• Projected peak sales

• USA $150-250 million

• targeted at the 60-80% of patients that do not get remission with 5 ASA's• After assessing safety data the entire 5 ASA market could be targeted

• RoW EUR 100 million

• Licensing revenue

• USA: licensed to Santarus; 12-14% royalties; plus 10% COGS for US• RoW: 25-33% total return• Japan: unpartnered

Cosmo Revenue scenarios for Budesonide MMX®

• Business case

• Between 60% (Lialda study) and 86% (Cosmo/Santarus study) of mild to

moderate patients do not go into remission with 5 ASAs

• In the US 850'000 persons have UC; 60% are mild to moderate • In the EU 850'000 persons have UC, 60% are mild to moderate

• Assuming 2 flares per year, between 1.2 m and 1.4 m flares p.a. are

ineffectively treated with 5 ASAs in USA and EU

• This is a market potential of $1-1.4 b

• 5 ASAs market in US is $ 1.4 b p.a.

• Cost per flare is around $ 840 • Patents expire 2022• Economics of licensing agreement in US and EU are such that pre tax NPV at

10% discount rate amounts to 84% of peak sales.

• 50% market penetration, Peak sales of $ 500 m, post tax NPV pS of CHF 19.38• 40% market penetration, Peak sales of $ 400 m, post tax NPV pS of CHF 15.50• 30% market penetration, Peak sales of $ 300 m, post tax NPV pS of CHF 11.63• 15% market penetration, Peak sales of $ 150 m, post tax NPV pS of CHF 5.81

• Rifamycin SV MMX

Rifamycin SV MMX®

• The chemical entity

• Broad-spectrum antibiotic belonging to the ansamycin family• New chemical entity in the US, Off-patent in EU

• Market need

• Need for a non-absorbable antibiotic that does not sterilize bacteria

• Does not promote bacterial resistance

• Competing products

• Rifaximin € 200 m• Ciprofloxacin € 331 m

• In USA and EU• Not partnered in Latin America, Asia nor Africa

Rifamycin SV MMX®: Status and opportunities

Clinical development

Patient recruiting for phase III trials in the US and EU ongoing

• Primary clinical endpoint: time to last unformed stool (TLUS)• EU trial: single phase III trial on around 700 patients, 400 mg b.i.d.

X 72 hours, non inferiority vs. Ciprofloxacin 500 mg b.i.d

• US trials: two consecutive phase III studies on 300 patients each,

400 mg b.i.d. X 72 hours, superiority vs. placebo

• Highly effective against Clostridium Dificile Associated Disease (CDAD)• Probably effective in Hepatic Encephalopathy• Due to its anti-inflammatory properties, Rifamycin SV MMX®

• Could also be used for IBD supportive therapies• Could be the drug of choice for the treatment of Diverticulitis, a

chronic disease that affects more than 60% of people over the age

LMW Heparin MMX

Cosmo's new business proposition for LMW Heparin

• 2 Cosmo drugs are targeted at induction of remission of

mild to moderate UC

• Lialda

• Budesonide MMX if approved

• Long term studies indicate that 50% of all patients will

be in remission at any given time

• The market value for maintenance should be about 2/3

of the induction of remission market

LMW Heparin inhibits the function and generation of

Intestinal Lining consisting of EpithelialCells -----------------------------------------

Decreased numbers of inflammatory

Th1, Th2, Th17 CD4+ T cells

Parnaparin inhibits Th1 and Th2 polarization

Secreted Cytokine

(Courtesy of M. Gerloni)

anti-CD3/CD28 + Parnaparin (ug/mL)

LMW Heparin MMX®

indication in maintenance of remission

• Completed phase IIb clinical trials; demonstrated that LMW

Heparin MMX®, when associated to 5-ASAs

• Has no side effects • Stops bleeding and is substantially more effective than 5-ASAs

• Possible target indication expanded to maintenance of

remission for UC patients of all severity

• New dose-ranging and POC study, designed as superiority vs. placebo, is planned

• - 3 doses of drug + placebo • - 200 patients approximately• - 12 months of therapy• - patient eligibility: patients with history of UC mild to moderate severity

coming in clinical remission (absence of blood in stools and absence of

diarrhoea since at least one week) from whatever treatment

• - maintenance criteria: absence of diarrhoea, absence of bleeding.

• - quarterly evaluation visits

LMW Heparin MMX®:

indication in maintenance of remission

• Pre-IND meeting with FDA results:

• LMW Heparin presently not approved in the USA, i.e. it is a new

• Full preclinical tests required including carcinogenesis tests

• EU partnering discussions and discussions for phase III trial

design planned in 2011

Cosmo's expanding business proposition

• So far focus has been on Ulcerative Colitis, a disease

that affects 1.7 m persons in the US and EU

• Next step has been to identify other areas where the

MMX technology can be applied that are

• Larger

• Can be accessed faster

• Yet have low competition

CB -01-16

Naloxone MMX

CB-01-16: opioid antagonist MMX

• Chemical entity: Naloxone

• Mechanism of action

• Naloxone is a powerful, off patent, opioid antagonist that displaces

opioids from the cell receptor.

• Activation of opioid receptors present in the intestinal wall induces

constipation. Specially affects long term users

• 1 h plasma half life when administered parenterally, so the extended

release formulations are needed

• When taken orally, has a very high first pass effect being practically

totally metabolized in the liver, without impairing analgesic effects

• MMX application

• MMX technology brings Naloxone to the colon only where it

displaces the opioid from their receptors thus restoring gut

peristaltic movements

CB-01-16: opioid antagonist MMX

• Market size

• In the US there are 12 m persons that are chronic opioid users and

more than 4.5 m persons that suffer from chronic opioid induced

• Target is the home market

• Status

• Phase I with dose escalation to start in H1 2011

• Market need; competition

• Currently no tablet is approved for use• NKTR 119 uses Naloxol through pegilation technology. Licensed to

CB-01-16: opioid antagonist MMX

• With 4.3 m persons with chronic constipation in the US

alone this is a large market

• No treatments available for home use

• Proof of concept can be achieved at low cost and fast

• Increasing dose Phase I will give quick indication whether

peristaltic movement can be improved without pain increase

• Poor experience of competitors

• a number of unsuccessful attempts at creating Naloxon

based tablets have been made

• New physician marketing base required

• Big marketing organization is required to market the drug

Methylene Blue MMX

Worldwide variation in colorectal cancer mortality rate

(cases per 100.000)

> 33.5/100.000

Costs of colorectal cancers

Colorectal cancer screening program

• Colorectal cancer is the third leading cause of death for

tumors in western countries

• It develops through a precursor (polyp) which can be

identified and removed during colonoscopy

• The core goal of colonoscopy is to detect all

premalignant polyps, primarily adenomas, and remove

• All western countries have largely adopted nationwide

screening programs with FOBT or colonoscopy to reduce

the incidence of colorectal cancer

Colonoscopy in colorectal screening program

• Observational studies show that colonoscopy-

based screening programs have resulted in:

- earlier detection of cancer

Hoff G, et al BMJ 2009, Gross CP JAMA 2006

- decreased incidence of colorectal cancer

Brenner H, Eur J Cancer 2009, Kahi CJ, Clin Gast Hep 2009

- decreased mortality from colorectal cancer

Baxter NN, Ann Intern Med 2009

But Colonoscopy is an imperfect diagnostic tool

• Population based studies suggest that 2% to 6% of

prevalent cancers are missed by colonoscopy

• Adenoma missing rate is around 15-20%

• Colonoscopy miss rate may be higher for lesions in

the proximal colon

• Colonoscopy miss rate may be higher for flat lesions

and for those smaller than 10 mm

Bressler B, Gastroenterology 2007

Farrar WD, Clin Gastroenterol Hepatol 200

Polyp miss rate determined by tandem colonoscopy:

van Rijn JC. Am J Gastroenterol 2006

Flat and Depressed Lesions are challenging to be

The Paris endoscopic classification of superficial neoplastic lesions

Gastrointest Endosc 2003

• Neoplasia in longstanding UC frequently develops in flat and

non-suspicious appearing mucosa

Ransohoff DF. Dis Colon Rectum 1985

Rubin CE. Gastroenterology 1992

Tytgat GN. Eur J Cancer 1995

Eaden JA. Gut 2001

Rutter M. Endoscopy 2004

Polyp detection rate

• In expert hands and with ancillary techniques (chromoendoscopy,

NBI, etc) should be around 50% in patients older than 50 y

• Appropriate detection impacts: therapeutic management, risk

stratification for cancer and follow-up programs

• Improper detection significantly increases costs management for

the single patients and the health system

What is our goal

• See more

• See better

• Differentiate: Adenoma vs hyperplastic

• Differentiate: Advanced vs early

The concept of chromoendoscopy for colonoscopy

• In chromoendoscopy, intravital dyes like methylene blue are

topically applied onto the mucosal surface

• The aim is to enhance superficial patterns and contrast

of pathologic versus normal mucosa

• This relatively old technique can be used in an untargeted fashion

("panchromoendoscopy") to increase detection of lesions

• Alternatively can be used in a targeted mode to define the borders

of the lesions and their pattern (adenoma vs hyperplastic or

adenoma vs carcinoma)

Methylene Blue dye (0,5%)

It's selectively absorbed by the normal colonic columnar cells

No uptake by the dysplastic or neoplastic cells

Increases the visibility of the structure because of the color

Homogeneous diffusion

Non-colored area or

Why Methylene Blue?

• Easily available for pharma use

• Long tradition as dye for foods

• Large number of studies on toxicity

• Long tradition in digestive endoscopy (> 20 y)

• Probably the most largest used dye in endoscopy

Narrow Band Imaging

Old Technique ('70s)

Developed by Japanese Experts

Chromoendoscopy with methylene blue

Adenoma Detection Rate

260 patients randomized to CE or SC

ol

Significant (P < 0.05) increase in the detection of adenomas (112

vs. 57), without a difference in extubation times

(17 vs. 15 min; P > 0.1)

Hurlstone DP. Gut 2004

What happens in real life with chromoendoscopy

• Boring

• Dye diffusion is not homogeneous

• Learning curve/standardization

Italian survey on chromoendoscopy

Why the use of dye is still scarcely adopted in

• Dye purchase and storage difficulties

• Dye preparation-dilution

• Dirty technique

• It takes pre-colonoscopy time and efforts (costs)

• It takes time if a "pan-chromo-colonoscopy" is required

MMX released methylene blue

• Revolutionary concept

• Easy and smart way to by-pass a number of issues precluding

large-scale adoption of chromoendoscopy

• MMX tablets containing methylene blue

• MMX technology targets release of the dye at colonic level

• Pre-colonoscopy dyeing of the mucosa

• No interference with standard bowel prep

The future of colonoscopy

CB-17-01: Methylene Blue MMX business rationale

• With 15 m colonoscopies in the US alone and > 30 m

WW this is a very large market

• The market potential is as high as all colonoscopies

• Great leeway in pricing

• Using the Methylene Blue tablet decreases time of

colonoscopy by up to 50% vs classical chromoendoscopy

• Inexpensive and fast to develop

• Proof of concept attained, major hurdle of PK study

successfully completed

• Clinical trials are fast, market entry targeted for end 2013

• New application with no competition in sight

• Anti Androgen

CB-03-01: Anti-androgen for topical applications

• Chemical name

• Cortexolone 17α-propionate

• Therapeutic Area Antiandrogenic (ATC D11 AX)

• New Chemical Entity (NCE) with antiandrogen properties, under

development for topical treatment

• Anti-androgen without systemic effects• Acts only at the level of the skin androgen receptor, blocking the

binding or displacing androgen hormones to the sebaceous gland

and to the hair follicle; additionally it has moderate anti

inflammatory activity

• Medical need

• A treatment for acne, sebborhea, alopecia and hirsutism that is

effective by topical application

• A topical treatment that provides a reliable alternative to retinoids

(poorly tolerated and presence of side-effects) and antibiotics/anti-

• Is not a skin irritant• Due to its peripheral effects, it does not induce hormonal imbalance

Endocrine control of androgen-dependent organs,

and mechanism of action

LHRH Analogues, Inhibitors

Cyproterone ac.

5a reductase

Finasteride, Dutasteride,

CB-03-01, Cyproterone ac., Flutamide

CB-03-01 has substantially stronger cell receptor

binding than Testosterone or DHT

Competitive curve at the LNCaP human androgen receptor

CB-03-01: does not inhibit 5 α-reductase nor influence skin

metabolism of testosterone to DHT

[14C]-testosterone and metabolites after transepidermal diffusion (24h)

Thin layer chromatography and autoradiography

a: 5α-androstane-3,17-dione, b: 4-androstene-3,17-dione, Testo:testosterone, DHT: 5-

dihydrotestosterone, e & f: polar metabolites

Unlike finasteride, CB-03-01 does not inhibit skin 5α-reductase, and does not

influence skin

metabolism of testosterone to DHT

CB-03-01: has a very simple and linear metabolic

pathway and metabolizes to safe cortexolone

• The final compound is cortexolone, whose safety profile is well known

• The aim is to achieve high local activity together with systemic safety thanks to

the in vivo hydrolysis pattern

CB-03-01: penetrates human skin better than

competitors

Skin concentration and permeation of CB-03-01 in PG/OL resulted about 2.5 and 10 times

higher than those of Cyproterone acetate

Clinical development and opportunities

• Status

• Phase I studies in volunteers successfully completed

• Product well tolerated• No measurable side effects• Drug permeates skin and is quantifiable in plasma (syst. abs <1%)

• Phase II proof of concept study on 72 patients with acne vulgaris [2009]

• Comparison to Retin-A and Placebo• Study completed • CB-03-01 statistically and/or clinically more effective than Placebo and

• CB-03-01 rapid onset of activity• CB-03-01 very well tolerated

• First topically effective anti-androgen treatment in the market

CB-03-01 1% cream

Phase II Study – Clinical Results

CB-03-01 1% cream

Retin-A 0.05 % cream

CB-03-01 1% cream

Phase II Acne Study Clinical Results - Summary

Efficacy of CB-03-01 1% cream in acne vulgaris

CB-03-01

0.05% cream

Total Lesion Count (TLC)

- % reduction vs. baseline, at weeks 8

- median time (days) to reach improvement 50%

Inflammatory Lesion Count (ILC)

- % reduction vs. baseline, at weeks 8

- median time (days) to reach improvement 50%

Acne Severity Index (ASI)

- % reduction vs. baseline, at weeks 8

- median time (days) to reach improvement 50%

Investigator Global Assessment (IGA)

- % of success at weeks 8

(a) statistically significant vs. Placebo (<0.001) and vs. comparator (<0.05)

(b) statistically significant vs. Placebo (<0.05)

(c) statistically significant vs. Placebo (<0.01)

CB-03-01 Phase I clinical development (I)

Pharmacokinetic of repeated doses

Study Design: Multiple dose, placebo-controlled, cutaneous tolerability and pharmacokinetic in adult healthy

Subjects: 24 volunteers of both sexes

CB-03-01 1% cream applied to fixed dorsal skin area at volume of 4 mL and 8 mL for 14 days;

Placebo cream applied to the control lateral side

Assessment: Local and systemic tolerability;

Determination of plasma concentration of CB-03-01 and free cortexolone, and urinary

excretion of CB-03-01, cortexolone and tetrahydrocortexolone after 1st, 10th and 14th

CB-03-01 1% cream was very well tolerated;

CB-03-01 was absorbed in blood stream in a proportion < 1% of the applied dose;

absorption and urinary excretion were not proportional to the volume applied

CB-03-01 Preclinical Development

Materno-foetal toxicity in rat and rabbit

Subcutaneous, daily doses 0, 1, 5, 25 mg/Kg b.wt

•Rabbit: Subcutaneous, daily doses 0, 0.1, 0.4, 1.5 mg/Kg b.wt

Results: No evidences that CB-03-01, at the tested doses, presented

unexpected materno-foetal toxicity in animals

CB-03-01 Phase I development : Skin irritation in man

Study Design: Multiple dose, randomized, positively and negatively controlled study

Subjects: 36 adults healthy volunteers of both sexes

CB-03-01 1% cream (0.2 mL), laurylsulfate 0.2% (0.2 mL) [positive control],

white petrolatum cream (0.2mL) [negative control] daily applied for 15 days

(22 days of exposure) to the dorsal skin

Skin irritation index

study ongoing (Final report planned: Feb 2011)

Planned an IND with FDA for clinical development in the USA

CB-03-01 in Androgenetic Alopecia (AGA)

Overview from a clinical, ambulatory experience (I)

To evaluate the efficacy and safety of CB-03-01 1% and 5%, compared to Cyproterone acetate and 17α-estradiol applied by hydroelectrophoresis to scalp of subjects affected by AGA

Single-centre, open-label, not randomized, four parallel groups evaluation

Subjects:

40 males affected by AGA (Hamilton grade I-IV)30 females of no child-bearing potential affected by AGA (Ludwig grade I)All subjects in good general conditions, not receiving AGA treatments in previous 6 months, and

signing informed consent form

Products:

CB-03-01 1% (males & females)CB-03-01 5% (males & females)Cyproterone acetate 1% (only females)17α-estradiol 1% (only males)

Treatment:

Test items dispersed in a specific gel for hydroelectrophoresis, and applied to the scalp by hydroelectrophoretic technique. Applications occurred once or twice a week, for five sessions of

about 20 minutes each

Assessments:

Clinical evaluation

Hair shaft diameter, Pull test, Wash test, Follicular density, Sebometric evaluation, Proportion of subjects improved

Confocal Microscopy Sebaceous gland size, Fibrosis evaluation, and Peribulbar inflammation

Evaluation performed at baseline, and 1 and 4 weeks after completion of treatment

CB-03-01 in Androgenetic Alopecia (AGA)

AN OVERVIEW FROM AN AMBULATORY EXPERIENCE (I)

RESULTS OF CLINICAL DATA:

Pull test

Wash test

Follicular

Sebometric

Subjects

improved

T1= one week after treatment completion; T2= four weeks after treatment completion

CB-03-01 at both concentrations 1% and 5% consistently increased hair diameter, follicular density and overall improvement

more than Cyproterone acetate 1% and 17α-estradiol 1%

CB-03-01 was also more active than comparators in improving pull test, wash test and sebometric evaluation

No evident difference of activity detected between the two concentrations of CB-03-01

No local or systemic effects were reported following the administration of the tested items

CB-03-01 in Androgenetic Alopecia (AGA)

AN OVERVIEW FROM AN AMBULATORY EXPERIENCE (III)

RESULTS OF CONFOCAL MICROSCOPY

The technique highlighted:

• an increase in the shaft diameter, mainly evident in CB-03-01 groups, as reported in clinical data table

• an impressive reduction of sebacious gland size, observed in about 85% of treated subjects.

• a decrease in dermal fibrosis, indicator of inflammatory process, after treatment mainly with CB-03-01

• a reduction of vessel diameter of peribulbar microvasculature

• a reduction of inflammatory cells after treatment with CB-03-01.

left) a follicular ostium partially

obstructed by the edges of the

sebaceous gland.

right) after the treatment with cortex

-17α-propionate 1%, the calibre of

the follicular ostium has increased

after a decrease in the dimension of

the sebaceous gland (150μm)

CB-03-01 in Androgenetic Alopecia (AGA)

AN OVERVIEW FROM AN AMBULATORY EXPERIENCE (II)

Reduction of vessel diameter of

peribulbar capillaries and a

decrease of the number of

inflammatory cells was noted

after treatment with CB-03-01

From left to right:

• reduction of dimension of sebaceous

• improvement of the follicolar units

the ostium ( 5 hair follicles)

• reduction of inflammatory and fibrotic

evidence around the ostium

Two patents have been filed, covering:

- the new molecular entities family and its application as antiandrogenic

EP 1421099

granted 2005 in EU, AUS, CHI, JP,CAN, KR, MEX, IN, pending USA

- the specific crystalline forms obtained with the different synthetic processes

pending approval in EU, AUS, CHI, JP,CAN, KR, MEX, IN, RU, USA, ZA

CB 03-01: alopecia Business rationale

Market potential

• It is presumed that around 40% of men between 20 and 65 suffer hair

loss and up to 40% of these try to do something about it

• Around 20% of these are willing to use drugs ie around

3% of all men

• Up to 50% of all women after menopause suffer hair loss and up to

60% of these try to do something about it

• Around 33% of these are willing to use drugs , ie

around 10% of all women>50

FDA approved drugs

• No topical anti androgen approved

• Propecia; an alpha 5 reductase inhibitor, taken as a tablet, had

revenues of $ 429 m (2008)

• Minoxidil/Regaine/Rogaine are vasodilators and are off patent

Outlook for 2011

• Continued growth in Lialda revenues by > 20%

• Growth of contract drug and generic manufacturing

by>10%

• Licensing agreements for CB 03-01 and LMW Heparin

• Slight increase in SG&A

• External R&D costs

• Anti Androgen

• Blue Methylene

• Opioid Constipation

Dr. Chris Tanner; CFO and Head of Investor Relations;

Dr. Luigi Moro; CSO

[email protected]: 0039-02-9333'7276

Source: http://www.investis.com/csm/presentations/RDday2010.pdf

Facts and Myths about Valley Independent Pharmacies Today, 7 in 10 prescriptions filled in the United States are for generic drugs. This fact sheet explains how generic drugs are made and approved and debunks some common myths about these products. FACT: FDA requires generic drugs to have the same quality and performance as the brand name drugs.

Skin Rejuvenating LaSeR Instructions for Use taBLe OF COntentS WELCOME TO LASER SKIN REJUVENATION WITH TRIA BEAUTY. gETTINg TO KNOW YOUR TRIA SKIN REJUVENATINg LASER ENJOY pROfESSIONAL ANTI-AgEINg RESULTS AT HOME. BEfORE USINg YOUR TRIA SKIN REJUVENATINg LASER fOR THE fIRST TIME With the Tria Skin Rejuvenating Laser you can reverse multiple signs of ageing, restoring your skin's natural radiance. Your new device is a true revolution in personal skincare